How can parents determine their financial priorities and meet their goals?

Parents and children – each of their futures is important and likely dependent on the savings of the older generation. Paths to college or retirement can vary widely by household. Of course, the best way to save for both is to start when you’re young and children are but a dream. With some financial planning, it’s possible to make college and retirement a reality. But when faced with the decision to save for college or retirement, what do you do? The simple answer is prioritize your own retirement. You’re the only person who can fund your own retirement, but your children have other college funding options.

How and When to Begin Saving Money

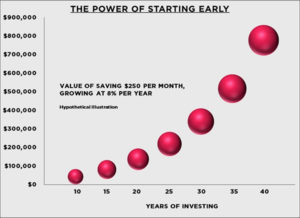

Start saving at the very beginning of your career, if not before. Even small amounts set aside will grow over time with prudent investing. At the start, the method of saving is less important. Just do it. However, taking advantage of tax-deferred strategies is always good whether with a 401(k) plan, especially with an employer match, or a college 529 plan. Do some of each. If you wind up not having children, you can use college plan assets yourself if properly set up. On the flip side, if you ultimately raise a large family, retirement plan loans may be helpful. Good saving habits are for children as well. Whether from allowances you provide when they’re very young or from part-time job income when appropriate, teach them to set some money aside for future needs—like college tuition. The graph here shows the important role time plays in accumulating and growing savings for the future.

College Savings: When to get serious

The start of high school is the time for some serious financial planning. Start with your retirement goal – when will you retire, what income will you need, how much has been saved, how will you get from here to there. Then turn to college needs. What impact on your own retirement plans will come from various levels of college funding?

Alternative College Funding

All college funding options should be utilized – savings, scholarships, grants, loans. Savings may be the smaller part in dollar terms, but developing good savings habits will pay other dividends over a lifetime. All scholarship and grant opportunities should be understood early and pursued aggressively. Do what it takes. Loans may be necessary but both parents and children should understand the reality of their longer-term consequences before incurring such debt. Have a clear view of the repayment reality, the impact on cost of living and quality of life once out of college.

College and Retirement Planning: A Team Effort

The reality of funding both education and retirement, especially simultaneously, may seem overwhelming. But favorable results can be achieved by starting early, identifying clear goals, engaging your children and pursuing all options.

Are you interested in learning more about saving for retirement or for your child's college expenses? Let us know and we will be in touch.