Overlapping goals

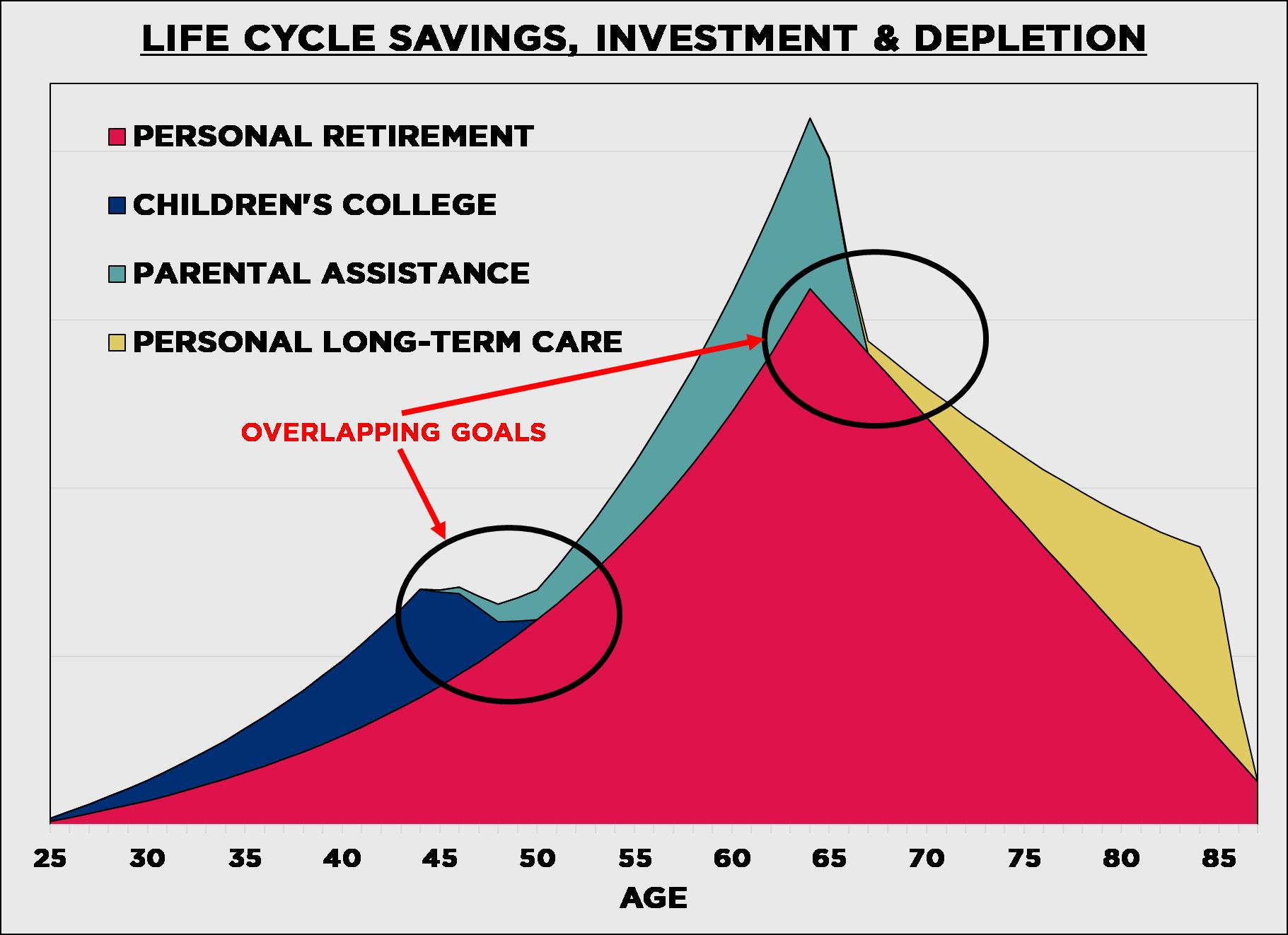

There is an idealized, straight life line that looks like this: grow and become educated; begin work life; marry and have children; save and spend for their education; save more and transition to retirement; support yourself in senior years. Real life is less a straight line and more a cycle of overlapping goals, each requiring attention and resources.

Circumstances vary widely among families, but a hypothetical picture can be drawn over a married lifetime for a couple with two children to educate and two parents to assist. Drawing on national averages for incomes, college costs, and senior living expenses, the funding burden on this family during the years of maximum overlap could approach 50% of disposable income. Such a financial demand calls for thoughtful strategies informed by current realities.

Harmonized Solutions

Some parameters shaping financial goals and their achievement today include:

•Education funding still generally starts at age 18, but it can begin as early as pre-school ages and run well into the 20s. With the middling cost of today’s four-year college education approaching $40,000 per year, all funding sources must be considered: 529 plans; scholarships; grants; loans; employment.

•Retirement income increasingly depends on personal saving. With longer life expectancies meaning longer retirement horizons and greater funding needs, all options must be considered: employer plans (especially with matching contributions); traditional IRAs; Roth IRAs; SEP IRAs; Social Security benefit optimization; delaying full retirement.

•National average costs today for one year each of assisted living and private-room full care are $48,000 and $100,400. With healthcare costs rising faster than the overall rate of inflation, all means must be explored: long-term care insurance; governmental support programs; healthcare provider initiatives; dedicated personal investments.

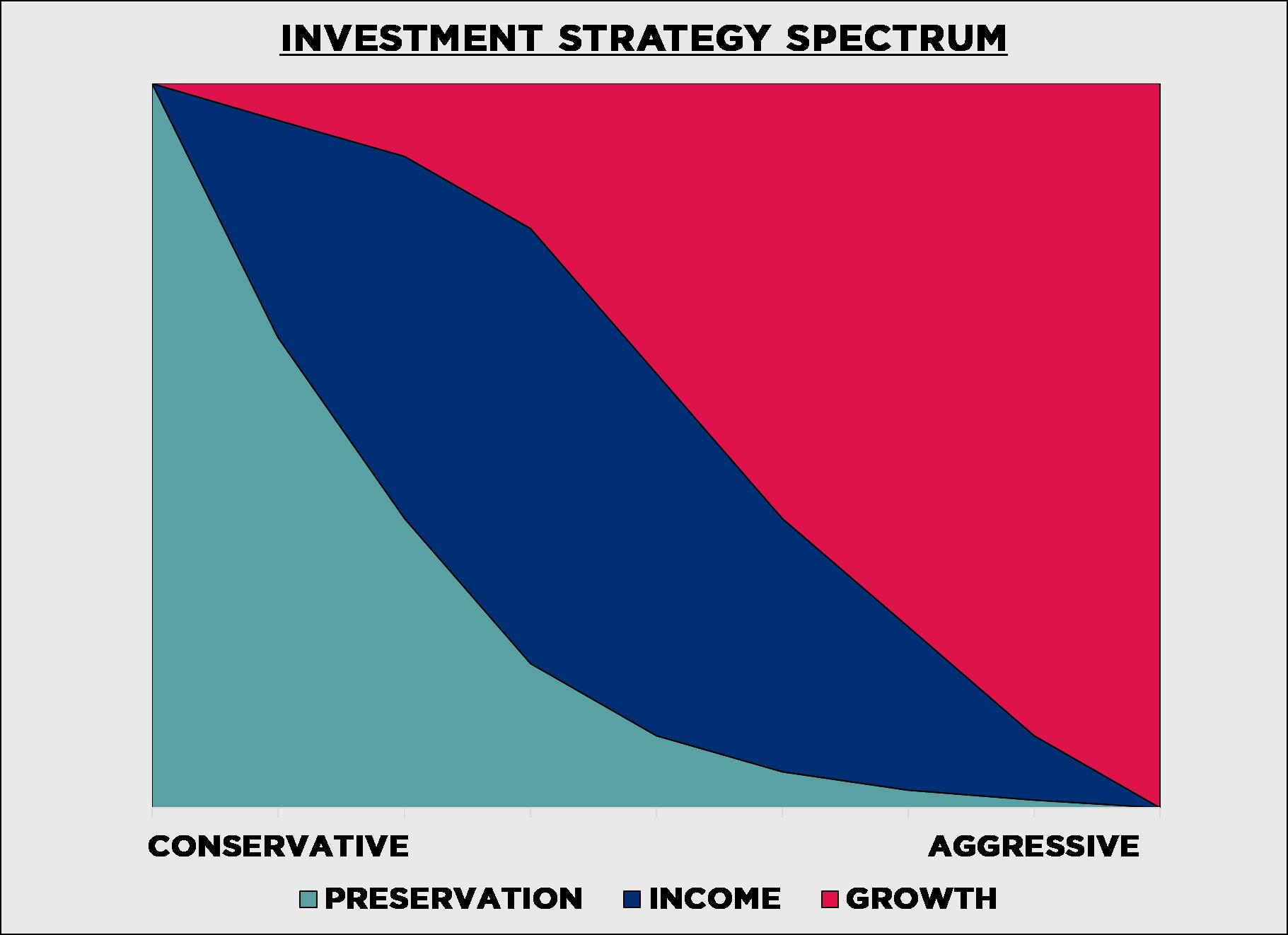

At any point in time, each financial goal is best met by one or more investment strategies. With overlapping goals, all investment strategies are in play and the mix needs to be harmonized over time as the life cycle evolves. Consequently, the most efficient and effective response is: build from the bottom up with clear goals, time horizons and risk tolerances; aggregate strategies from the top down; and invest with a comprehensive and disciplined process.

Are you interested in learning more about harmonizing your financial goals and investment strategies? Let us know and we will be in touch.