What benefits can Social Security recipients expect in the future?

Social Security COLA Benefits

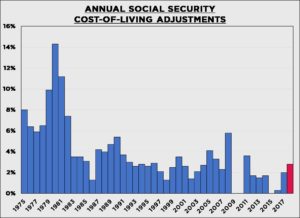

Social security benefits are a core financial resource for many retiree households. Since 1975, benefits have been subject to a cost-of-living adjustment (“COLA”). This adjustment is calculated by formula each year, based on the third-quarter to third-quarter change in the Consumer Price Index (“CPI”). The COLA is applied to benefits determined in December and paid initially in January. The graph here shows the annual COLAs from 1975 through 2018. The +2.8% increase for benefits paid in 2019 is the second highest in the past decade.

If there is no increase in the CPI as calculated, there is no COLA. In fact, there was no COLA in 2009, 2010 and 2015, and the 2016 COLA was a negligible +0.3%. Inflation has been muted in recent years to the point that concern has arisen over the potential for price deflation, the outright decline in the CPI. An indication of this possibility today is negative yields for many bonds outside the U.S. Rules can be changed, but current regulation does not permit a COLA adjustment reducing benefits due to price deflation. This makes Social Security benefits even more attractive if the COLA remains constrained to no change even when overall prices decline.

If there is no increase in the CPI as calculated, there is no COLA. In fact, there was no COLA in 2009, 2010 and 2015, and the 2016 COLA was a negligible +0.3%. Inflation has been muted in recent years to the point that concern has arisen over the potential for price deflation, the outright decline in the CPI. An indication of this possibility today is negative yields for many bonds outside the U.S. Rules can be changed, but current regulation does not permit a COLA adjustment reducing benefits due to price deflation. This makes Social Security benefits even more attractive if the COLA remains constrained to no change even when overall prices decline.

Social Security Financial Planning Benefits

Some argue that Social Security benefits are merely a return of taxes paid over a lifetime of working. In this view, if you get back less in benefits than taxes paid, it was a bad deal. A lot of calculations and assumptions go into drawing any such conclusion. Without Social Security, however, you would have to accumulate substantial savings just to replicate these benefits throughout retirement. The average annual Social Security benefit to a couple in 2019 is $29,376. A couple at normal retirement age of 66 has a joint survival horizon of 25 years. An equally safe, 25-year U.S. Treasury bond yields about 2.0% today. If one were willing to spend all principal and interest (not a recommended strategy), an initial investment of about $692,000 would be required. Social Security benefits are a very valuable retirement resource.

Think of Social Security benefits as part of your retirement portfolio. As such, they are comparable to owning a traditional high-quality bond but with three additional features: automatic COLA; survivor horizon certainty; no market risk. When thought of this way and included in your portfolio, the make-up of your investments might be different. You may be able to maintain the same potential level of annual withdrawal from your portfolio with a lower level of risk. Alternatively, you may achieve a higher potential level of annual withdrawal at the same level of risk without Social Security. Either way, begin with clear goals, time horizons and tolerance for risk. And include Social Security benefits as they are a valuable portfolio asset.

Are you interested in learning more about Social Security benefits? Let us know and we will be in touch.